indiana tax payment voucher

For purposes of filing the Indiana Fiduciary Income Tax Return estates and trusts are classified as either resident or nonresident. Lines J K and L If you are paying only the amount of estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form.

Please allow 7 to 10 business days for delivery via US.

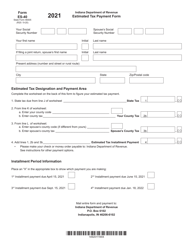

. If you have specific questions about a bill call our payment services team at 317 232-2240 Monday through Friday 800 am. I cannot find a payment voucher to send in an amount due. Estimated tax is the method used to pay tax on income that isnt subject to withholding for example earnings from self-employment interest dividends rents alimony etc.

Enter this amount on line 4 Estimated Tax Installment Payment at the top of the form. To make payments toward a previous tax year filing please select or link to the Individual Tax Return IT-40 payment option. You may pay by using the Indiana ePay System.

Estimated payments may also be made online through Indianas INTIME website. Eric Holcomb said. Holcomb gives timeline of 125 Indiana tax refund payments.

Contact the Indiana Department of Revenue DOR for further explanation if you do. On my tax return I have 4 estimated tax payment vouchers of 559 each that were calculated by turbo taxThis was a one time withdrawal that more than doubled my income for this year. Know when I will receive my tax refund.

This option is to pay the estimated payments towards the next year tax balance due. Income Tax Return for Estates and Trusts before you begin filling out Indianas Form IT-41. There will be instructions above the voucher section.

2021 IT-40 Income Tax Form. You will come to a screen titled Indiana E-Filing Step - Form IT-8453-OLPFC where you can print the voucher. Indiana payment vouchers.

Line I This is your estimated tax installment payment. If you print or view the instructions from the screen titled E-filing - Print Indiana E-file Instructions there is additional information regarding paying the balance due to Indiana. Previously entered into a tax pre-collection agreement with their supplier or permissive supplier and who imports special fuel from another state into Indiana in vehicles with a capacity greater than 5400 gallons.

More about the Indiana Form ES-40 Estimated. Indiana Department of Revenue Consumers Use Tax Return. I took a payout on my 401k and the amount that was deducted for state and local tax wasnt enough so I needed to pay 131100 on my state.

430 pm EST. Have more time to file my taxes and I think I will owe the Department. Take the renters deduction.

When filing you must include Schedules 3 7 and CT-40 along with Form IT-40. For estates residence is based on the decedents. 23 rows Page one of the Indiana Form ES-40 file is the fillable voucher for the 2021 tax year.

You can also order federal forms and publications by calling 1. We will update this page with a new version of the form for 2023 as soon as it is made available by the Indiana government. Box 6192 Indianapolis IN 46206-6192 24100000000.

Take the renters deduction. Is there a voucher or is on-line the only option. In addition if you dont elect voluntary withholding you should make estimated tax payments on other.

Coupons will be delivered to the business address on file currently with the Department of Revenue. Lines J K and L If you are paying only the amount of estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. The credit will be reflected on the Schedule IN K-1 for each beneficiary.

Indiana Department of Revenue PO. You may pay via the Internet by telephone or by mail. Line I This is your estimated tax installment payment.

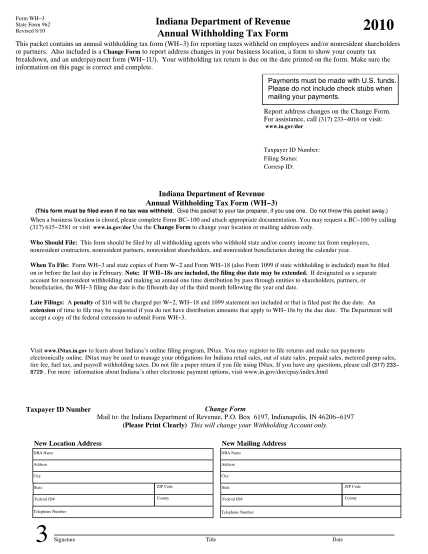

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable. When is this form and payment due.

Claim a gambling loss on my Indiana return. 2022 Indiana Estimated Tax Payment Form. 2021 Indiana Unified Tax Credit for the Elderly.

Pay my tax bill in installments. Pay my tax bill in installments. Please complete the form below and click submit to order coupons to pay your Indiana taxes.

Your electronically filed 2012 Indiana Individual Income Tax Return indicates a balance owed to the Indiana Department of Revenue in the amount of. Enter this amount on line 4 Estimated Tax Installment Payment at the top of the form. For further information consult Income Tax Information.

This service uses a paperless check and may be used to pay the tax due with your Indiana individual income tax return as well as any billings issued by the Indiana Department of Revenue for any tax type. Find Indiana tax forms. We last updated Indiana Form ES-40 in January 2022 from the Indiana Department of Revenue.

When you receive a tax bill you have several options. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. We last updated the Estimated Tax Payment Voucher in January 2022 so this is the latest.

INDIANAPOLIS An estimated 43 million Hoosiers will get something extra in their bank accounts this summer. Send in a payment by the due date with a check or money order. Avoid penalty and interest charges by making your payment before the April 15 2013 tax due date.

Have more time to file my taxes and I think I will owe the Department. This voucher must be submitted with your payment within 3 business days Prior to July 1 2017after. Mail form and payment to.

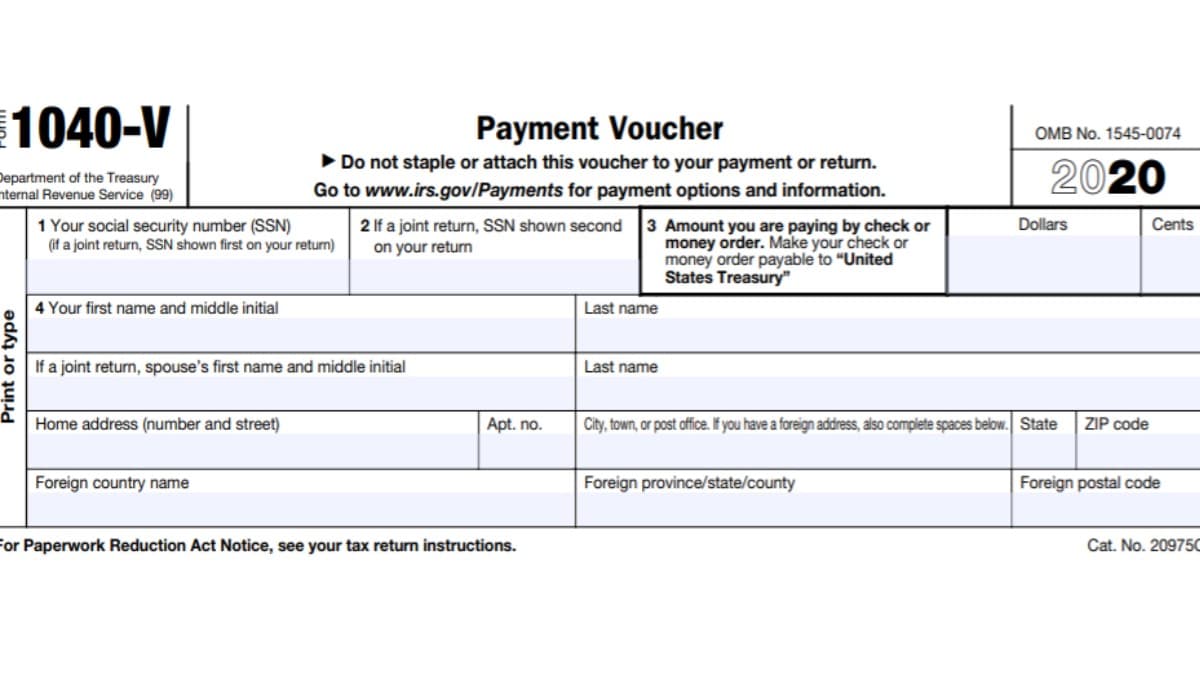

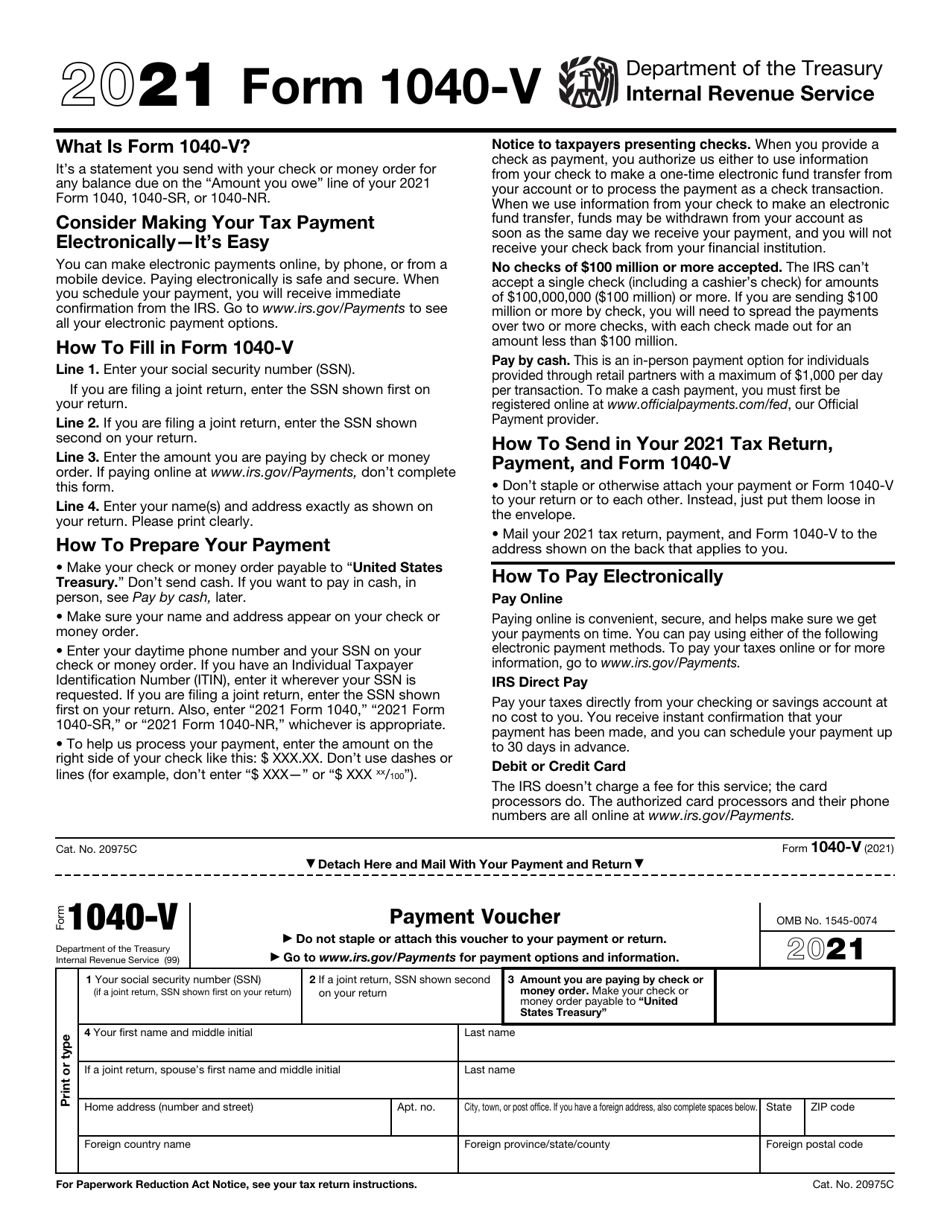

Use Form 1040-ES to figure and pay your estimated tax for 2022. Know when I will receive my tax refund. If you need to contact the IRS you can access its website at wwwirsgov to download forms and instructions.

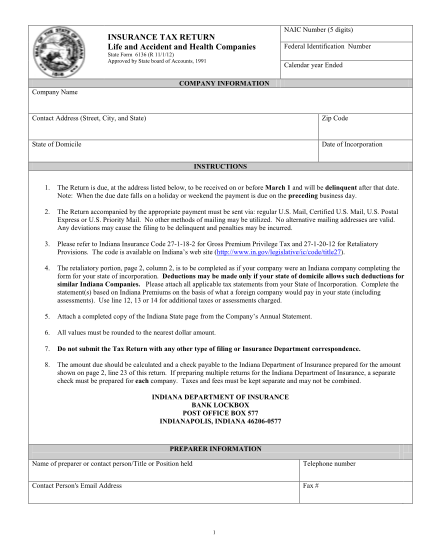

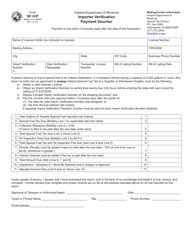

Claim a gambling loss on my Indiana return. Fiduciary Payment Voucher Estimated Tax Extension or Composite Payment For the calendar year or fiscal year beginning and ending Federal Employer Identification Number of Trust or Estate. This form is for income earned in tax year 2021 with tax returns due in April 2022.

Find Indiana tax forms. Fiduciary Estimated Tax and Extension Payment Voucher Form IT-41ES Form IT-41ES Indiana Department of Revenue Fiduciary Payment Voucher Estimated Tax Extension or Composite Payment State Form 50217 R11 8-21 For the calendar year or fiscal year beginning and ending Federal Employer Identification Number of Trust or Estate Name of Trust or Estate Name and. Fill in the form save the file print and mail to the Indiana Department of Revenue.

You must include Schedules 1 add-backs 2 deductions 5 credits such as Indiana withholding 6 offset credits and IN-DEP dependent information if you have entries on those schedules.

Printable 2021 Indiana Form Es 40 Estimated Tax Payment Voucher

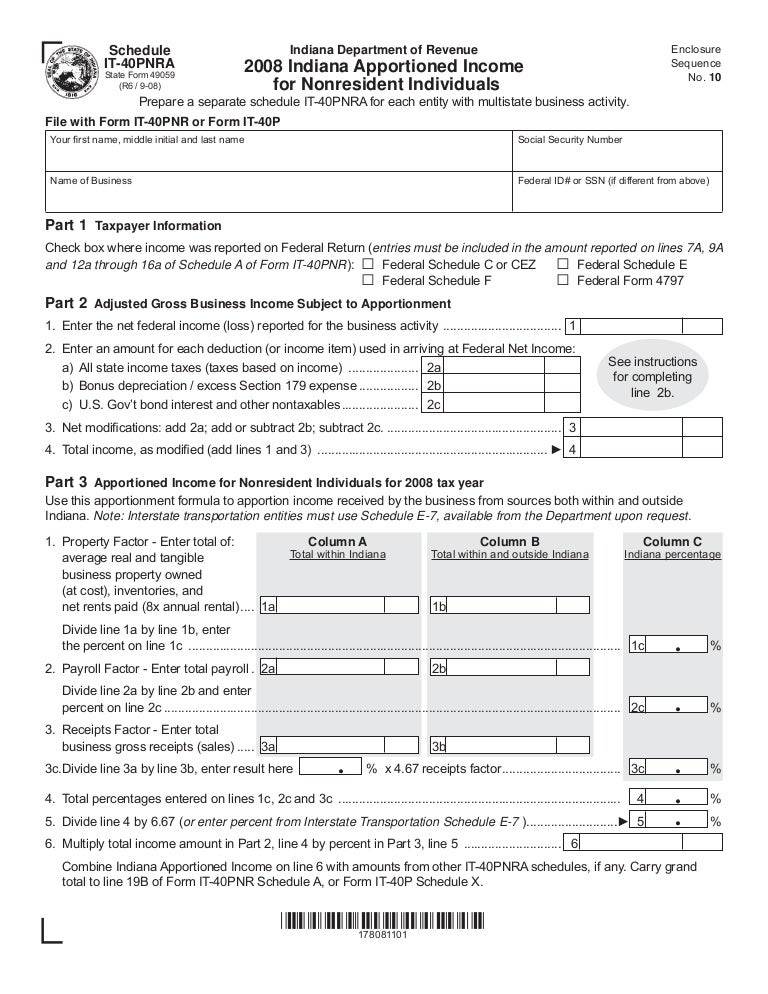

Indiana Apportionment Schedule For Nonresident Individuals

19 Indiana Tax Forms Free To Edit Download Print Cocodoc

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Oregon Tax Forms 2021 Printable State Form Or 40 And Form Or 40 Instructions

19 Indiana Tax Forms Free To Edit Download Print Cocodoc

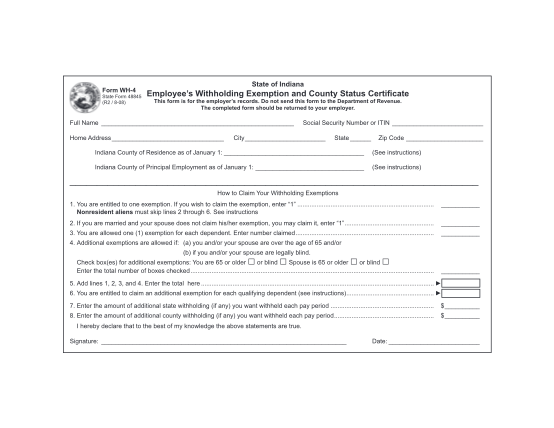

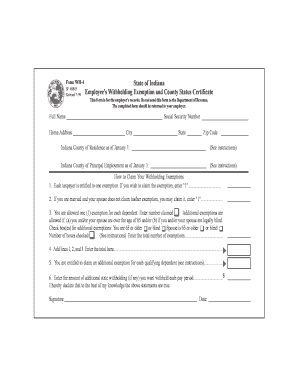

Indiana W4 Fill Online Printable Fillable Blank Pdffiller

Tax Forms At The Library New Castle Henry County Public Library

19 Indiana Tax Forms Free To Edit Download Print Cocodoc

Irs Form 1040 V Download Fillable Pdf Or Fill Online Payment Voucher 2021 Templateroller

Indiana Apportionment Schedule For Nonresident Individuals

Indiana Estimated Tax Payments 2021 Fill Online Printable Fillable Blank Pdffiller

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Download Instructions For Form St 103 Sales Tax Vouchers And Or Electronic Funds Transfer Credit Recap Pdf Templateroller

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Indiana Form It 6 Fill Out And Sign Printable Pdf Template Signnow

Form Sf Ivp State Form 46635 Download Fillable Pdf Or Fill Online Important Verification Payment Voucher Indiana Templateroller